Disclaimer: Each post is for informational purposes only. It is not a solicitation, a recommendation or advice to buy or sell any security or investment product. Information provided in each post does not constitute investment advice.

Thursday, December 31, 2020

2020 Weekly Commentary

* Wedging Again?(12/18/20)

* Convergence (12/11/20)

* Tracking the Large Structure (12/4/20)

* INDU caught up to ATH (11/27/20)

* Another Slow Market (11/20/20)

* A Slow Market (11/13/20)

* Election Week (11/6/20)

* Election Risk Premimum (10/30/20)

* A Week Before THE Elecion (10/23/20)

* Probing (10/16/20)

* ABC down & ABC up (10/9/20)

* October Volatility (10/2/20)

* Suspense (9/25/20)

* Down Swing (9/18/20)

* Building Blocks (9/11/20)

* Reaction (9/4/20)

* Worth Repeating (8/28/20)

* Small Wedge (8/21/20)

* Jigsaw (8/14/20)

* Gap Filled (8/7/20)

* Gap (7/31/20)

* Gap (7/24/20)

* Update (7/17/20)

* Probing Support (6/26/20)

* Update (6/19/20)

* Perspective (6/12/20)

* Probing New High (6/5/20)

* Wedges (5/29/20)

* WXY (5/22/20)

* WXY (5/15/20)

* Short Term Update (5/9/20)

* Fib618 Retrace (5/1/20)

* Probing (4/24/20)

* At Sup/Res Zone(4/17/20)

* Approaching Sup/Res Zone(4/9/20)

* Rebound(4/4/20)

* Rebound or Bull-Trap (3/27/20)

* Near Term Bottom Fishing (3/20/20)

* ABC/123 and Long Term Tracking (3/13/20)

* Reversal(3/6/20)

* High - part 2(2/28/20)

* High(2/21/20)

* Wedging(2/14/20)

* Update(2/7/20)

* Reversal or Small-Degree Pullback (1/24/20)

* Reversal or Larger-Degree Pullback (1/24/20)

* Expanding EDT and Triple ZigZag (1/17/20)

* Tracking and Squiggles (1/10/20)

* Update (1/3/20)

Monday, December 28, 2020

Monday Update (12/28/20)

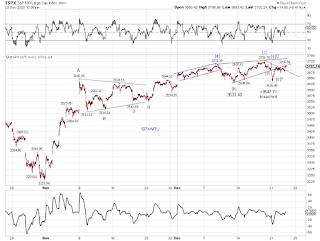

Today's uptick EITHER invalidates the gray wedge OR the gray wedge is part of wave [b]-up of the blue B-down.

This interpretation leaves two short term tracking counts with different upside potential- the green [c] of C-up or the blue C-up.

See charts.

Friday, December 25, 2020

Wednesday, December 23, 2020

Wednesday Update (12/23/20)

[EOD] -

Only 5 points away from invalidating the wedge failure at the day's high. The EOD decline filled the gap at the open and sent SPX back to the gray line.

[1038am NYSE] -

SPX gaped over short term decline line (gray) and is probing the (rising) underside of the wedge a second time. Also points away from invalidating the wedge failure.

Tuesday, December 22, 2020

Tuesday Update (12/22/20)

Closed below the underside of the wedge. Small consolidation has been running since the rebound high.

Monday, December 21, 2020

Monday Update (12/21/20)

[EOD] -

Hugging the underside of the wedge at the close.

[120pm NYSE] -

If we indeed have a wedge discussed over the weekend, price action confirms its failure. Current rebound is kissing the underside of the wedge.

Friday, December 18, 2020

MTU Weekend Ed - Wedging again? (12/18/20)

SPX is crawling along an overhead trend line while making new record highs while doing so.

We now have 4 legs of a potential small wedge to conclude a zigzag since Nov. Based on today's low, the 5th leg is capped at 3779.14 to coincide with the Santa rally, or could fail - given the end of day rebound, a breach of the wave [d] floor of 3647.71 would offer initial confirmation of a failure.

Friday, December 11, 2020

Saturday, December 5, 2020

MTU Weekend Ed - Tracking the Larger Structure (12/4/20)

If the prior upswing in SPX ended in 2018 (red), the upside potential of this corrective structure (wxy or expanding triangle) is likely met soon.

Thursday, December 3, 2020

Wednesday Update (12/3/20)

SPX is at the gray trend line, could it be all of the red [y] or part or all of the blue [z]?