Happy New Year!

Stocks -

The final upswing of the Hope Rally is likely in progress (

Chart 1). The fiscal-cliff related decline is likely a temporary pullback. The sell-off has now pushed SP500 to the proposed target area around 1395 based on our analysis of the potential fractal (

Chart 2). See

Cliff (12/21/12) for more discussions on the proposed fractal. See

Market Timing Update (12/28/12) for near term tracking counts and squiggles.

Bonds -

Bonds -

U.S. 10Y Treasury note yield is wrapping up a potential zigzag decline which has lasted more than three decades (

Chart 3). The proposed wave [C] of the decline in yield is likely an ending diagonal triangle as indicated in

Chart 3 and analyzed in

Chart 4.

It is anyone's guess when and where the proposed EDT would end. As long as 10Y yield finds its low above 46bp (0.46%), the proposed EDT survives. In reality, the recent low around 1.39% is as good a low as others, and around 0.97% is a decent spot for an overthrow as well as support.

USD -

USD -

The USD index is likely to be range bound for some time, likely as part of a larger triangle (

Chart 5). A piece of supporting evidence is that the recent advance from the 2011 low counts better as a three-wave structure than a five-wave one (

Chart 6). Whether the proposed triangle is bearish (

Chart 5, blue) or bullish (

Chart 5, green) for the green back remains to be seen - the 2012 high and 2011 low are thus key pivots.

Gold -

Gold -

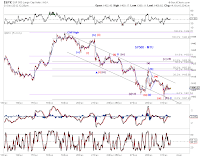

Gold is likely in a wave [4] decline off its low around the turn of the century (

Chart 7). Once wave [4] concludes, wave [5] should push gold to a new high.

Since the proposed wave [2] sell-off was deep, the current wave [4] correction is likely sideways based on wave structure's tendency to alternate.

Chart 8 presents our primary wave count on gold off its recent major low, the 2008 financial crisis low.