[1535pm] SPX update-

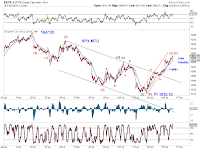

So far a fake breakout (Chart 1-gray line) and a retest of the channel (Chart 2- red line). Updated DT squiggles (Chart 2).

[1245pm] SPX update-

Potential DT is still tracking, but pullback to 1925-30 a possibility. If DT fails, next support around 1880/90. See chart.

[805am] ES/SPX update-

Possibility of an diagonal triangle? See charts.

Disclaimer: Each post is for informational purposes only. It is not a solicitation, a recommendation or advice to buy or sell any security or investment product. Information provided in each post does not constitute investment advice.

Monday, February 29, 2016

Friday, February 26, 2016

MTU Weekend Ed. - Monthly Outlook Update (2/26/16)

Stocks, Bonds, USD, Gold - key intermediate term scenarios to watch

Stocks

SP500 breached its January crash low in February but quickly and meaningfully rebounded. It is important to note that Dow30 and MidCap-SP400 did not suffer a lower low. Thus, the decline from the November high either ended or is missing a fifth wave decline (Chart S1).

With the short-term uncertainty being noted above, we discuss the intermediate term bullish and bearish scenarios, with the assumption that the upswing from the 2009 bottom is still incomplete.

[Bullish, Chart S2] Wave [4]-down from the nominal high completes at levels around the Feb low.

[Bearish, Chart S3] Wave [4]-down began in Q3 of 2014, tracing out a flat-light structure. wave (c)-down of the flat is a contracting or expanding EDT-like structure. This potential EDT is still missing wave d-up and e-down, with a final target potentially between 1650 and 1750.

Bonds

The 10Y Treasury Yield completed the right shoulder of a head-and-shoulders pattern (Chart B1). The market is at a critical juncture right now. A fulfilled H&S patterns would likely mean current speculation of negative nominal interest rates has much merit, whereas a failed H&S would suggest a meaningfully higher interest rate environment is in sight.

USD

If the USD index has not topped (Chart $1-green), its year-long consolidation may not be complete (Chart $2-blue, red).

Gold

The smart rise in Gold prices from the 2015-Q4 low strongly suggests that the entire decline (or the first major part of the decline) from the 2011 may be over following the completion of a contracting EDT (Chart G1-blue).

However, wave [e] of the proposed contracting EDT is either very compressed or uncharacteristically short (and lacks the final up-and-down subdivision).

This introduces another possibility that the rebound in Gold is only wave [d]-up of an expanding EDT (Chart G1-red). A higher high would eliminate this possibility.

Stocks

SP500 breached its January crash low in February but quickly and meaningfully rebounded. It is important to note that Dow30 and MidCap-SP400 did not suffer a lower low. Thus, the decline from the November high either ended or is missing a fifth wave decline (Chart S1).

With the short-term uncertainty being noted above, we discuss the intermediate term bullish and bearish scenarios, with the assumption that the upswing from the 2009 bottom is still incomplete.

[Bullish, Chart S2] Wave [4]-down from the nominal high completes at levels around the Feb low.

[Bearish, Chart S3] Wave [4]-down began in Q3 of 2014, tracing out a flat-light structure. wave (c)-down of the flat is a contracting or expanding EDT-like structure. This potential EDT is still missing wave d-up and e-down, with a final target potentially between 1650 and 1750.

Bonds

The 10Y Treasury Yield completed the right shoulder of a head-and-shoulders pattern (Chart B1). The market is at a critical juncture right now. A fulfilled H&S patterns would likely mean current speculation of negative nominal interest rates has much merit, whereas a failed H&S would suggest a meaningfully higher interest rate environment is in sight.

USD

If the USD index has not topped (Chart $1-green), its year-long consolidation may not be complete (Chart $2-blue, red).

Gold

The smart rise in Gold prices from the 2015-Q4 low strongly suggests that the entire decline (or the first major part of the decline) from the 2011 may be over following the completion of a contracting EDT (Chart G1-blue).

However, wave [e] of the proposed contracting EDT is either very compressed or uncharacteristically short (and lacks the final up-and-down subdivision).

This introduces another possibility that the rebound in Gold is only wave [d]-up of an expanding EDT (Chart G1-red). A higher high would eliminate this possibility.

Thursday, February 25, 2016

Market Timing Update (2/25/16)

[EOD] Stocks-

SPX closed above MA50 and overhead resistance, which is bullish (Chart 1). Interesting near term wave structures are present (Chart 2).

A bullish expanding triangle (Chart 2-red) or an initial reversal on a breakout failure (Chart 2 blue [i]) target around 1880 (potentially filling the gap below), where as a continued wave C-blue or a wave 3-green has meaningful upside potential, 1970 area for the former and the gap around 2040 for the latter.

[145pm] SPX update-

SPX probes overhead resistance and MA50 once again. See charts and squiggles.

[727am] ES update-

An LDT decline and rebound overnight or a C or 5th wave since 1886.25? See chart.

SPX closed above MA50 and overhead resistance, which is bullish (Chart 1). Interesting near term wave structures are present (Chart 2).

A bullish expanding triangle (Chart 2-red) or an initial reversal on a breakout failure (Chart 2 blue [i]) target around 1880 (potentially filling the gap below), where as a continued wave C-blue or a wave 3-green has meaningful upside potential, 1970 area for the former and the gap around 2040 for the latter.

[145pm] SPX update-

SPX probes overhead resistance and MA50 once again. See charts and squiggles.

[727am] ES update-

An LDT decline and rebound overnight or a C or 5th wave since 1886.25? See chart.

Wednesday, February 24, 2016

Market Timing Update (2/24/16)

[EOD] Stocks-

SPX retests and bounces off the blue "line in the sand", filling two upward gaps in the process (Chart 1). Tracking squiggles on the intraday rebound (Chart 2) and the rebound from 1810 (Chart 3).

[225pm] SPX update-

5-up or double zigzag in an attempt to fill today's gap. Nested 1s2s a possibility if the upswing runs. See chart.

[9am] ES update-

Now a larger 5-wave decline from the rebound high in ES. Tracking count from the low. See chart.

SPX retests and bounces off the blue "line in the sand", filling two upward gaps in the process (Chart 1). Tracking squiggles on the intraday rebound (Chart 2) and the rebound from 1810 (Chart 3).

[225pm] SPX update-

5-up or double zigzag in an attempt to fill today's gap. Nested 1s2s a possibility if the upswing runs. See chart.

[9am] ES update-

Now a larger 5-wave decline from the rebound high in ES. Tracking count from the low. See chart.

Tuesday, February 23, 2016

Market Timing Update (2/23/16)

[125pm] SPX update-

[740am] ES update-

A decent shaped five wave decline from the high in ES overnight. See chart.

[740am] ES update-

A decent shaped five wave decline from the high in ES overnight. See chart.

Monday, February 22, 2016

Market Timing Update (2/22/16)

[215pm] SPX update-

SPX fills the green gap today and approaches MA50, at the cost of three red gaps (Chart 1). Chart 2 presents squiggles from the low.

SPX fills the green gap today and approaches MA50, at the cost of three red gaps (Chart 1). Chart 2 presents squiggles from the low.

Saturday, February 20, 2016

MTU Weekend Ed. - Short Term Update (2/19/15 close)

SPX is back inside prior channel and closed above prior key support line, which is bullish.

Bullish count - new impulse to new highs.

Near term bullish count - ABC rebound on a wave B or wave 2 retrace, but with meaningful upside.

Near term bearish count - a wave 4 flat or triangle, with limited upside.

Bullish count - new impulse to new highs.

Near term bullish count - ABC rebound on a wave B or wave 2 retrace, but with meaningful upside.

Near term bearish count - a wave 4 flat or triangle, with limited upside.

Friday, February 19, 2016

Thursday, February 18, 2016

Market Timing Update (2/18/16)

[EOD] Stocks -

SPX cash index fall short of an overhead gap and pulled back (Chart 1) where as futures filled the gap with a higher rebound high. SPX cash delivered an inside day today. Hence the overall assessment remains unchanged from yesterday - "The current upswing is most likely an impulse wave. Does it initiate a new upswing following a W-bottom (Chart 2 blue) or wave [c] of a bearish flat(Chart 2 red)?"

SPX cash index fall short of an overhead gap and pulled back (Chart 1) where as futures filled the gap with a higher rebound high. SPX cash delivered an inside day today. Hence the overall assessment remains unchanged from yesterday - "The current upswing is most likely an impulse wave. Does it initiate a new upswing following a W-bottom (Chart 2 blue) or wave [c] of a bearish flat(Chart 2 red)?"

Wednesday, February 17, 2016

Market Timing Update (2/17/16)

[EOD] Stocks-

The current upswing is most likely an impulse wave. Does it initiate a new upswing following a W-bottom (Chart 1 blue) or wave [c] of a bearish flat (Chart 1 red)? Chart 2 and Chart 3 update our weekend discussion and present how it fits into larger-degree scenarios.

[1055am] SPX update-

SPX is now above the blue and gray resistance lines (Chart 1), following two upward gaps. Let's see if there is a retest and gap fill. Squiggles are in Chart 2.

The current upswing is most likely an impulse wave. Does it initiate a new upswing following a W-bottom (Chart 1 blue) or wave [c] of a bearish flat (Chart 1 red)? Chart 2 and Chart 3 update our weekend discussion and present how it fits into larger-degree scenarios.

[1055am] SPX update-

SPX is now above the blue and gray resistance lines (Chart 1), following two upward gaps. Let's see if there is a retest and gap fill. Squiggles are in Chart 2.

Tuesday, February 16, 2016

Market Timing Update (2/16/16)

[115pm] SPX update-

SPX is now at the blue and gray resistance lines and is trying to break into prior range. See charts.

[915am] ES update-

SPX is now at the blue and gray resistance lines and is trying to break into prior range. See charts.

[915am] ES update-

Saturday, February 13, 2016

MTU Weekend Ed. - Retesting the Low (2/12/16 close)

Stocks retested their January low this past week (Chart 1 and Chart 2). Tech and small caps managed lower lows while the January lows largely held for mid-to-large caps. SP500 also managed to close inside the downward channel since its nominal high, which is bullish on balance.

Chart 3 presents the near term tracking of the decline from 1947.20 in SPX. The bullish blue scenario is that a five-wave decline ended at 1810.10 whereas the bearish red/gray scenario calls for one more retest of the lows once a small degree wave [4] flat/triangle is complete.

Recent price actions have elevated the likelihood of two of the larger degree tracking scenarios.

First, a fourth wave correction since late 2014 orthodox high in SPX is ending (Chart 4). This correction takes the form of an expanded flat. The decline from the nominal high in SPX is its final wave, which takes the form of an expanding diagonal triangle. If so, those who interpret the next rebound as a fourth wave is likely to be disappointed (see the Second scenario below).

Second, a fourth wave correction from the nominal high in SPX is ending (Chart 5 green) or is subject to one more meaningful up-down subdivision (Chart 5 red). This correction takes the form of a simple ABC structure where SPX closed inside the channel Friday.

Friday, February 12, 2016

Market Timing Update (2/12/16)

[9am] ES update -

If ES wishes to deliver a proper EDT with another decline, the red labels present a possibility.

If ES wishes to deliver a proper EDT with another decline, the red labels present a possibility.

Subscribe to:

Posts (Atom)