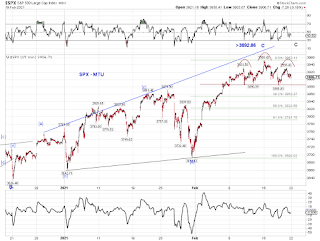

It's a good time to review the higher-degree tracking once more.

Short term, a head-and-shoulders pattern successfully played out over the past week. We are looking at the green [c]-up or a reversal (see the higher-degree tracking above) with a potentially failure in the blue (c)-up of [e]-up.