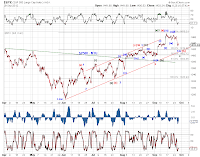

A week later, SPX did breach 1449.98 and has made further progress to the downside (to as low as 1433.32) and the Dow closed solidly below the upper trend line of a proposed EDT/wedge in what appears to be a five wave decline from a truncated high (Chart 2, red).

So trend-reversal watch is on.

However, price structures of the decline across leading indexes also suggest the possibility of a corrective pullback. For example,

[1] From the orthodox high, SPX fails to make a lower low on Friday to complete a five-wave decline, presenting a potential bullish divergence.

[2] From the nominal high, the Dow has so far traced out a corrective flat decline, the SPX a double three pullback and NDX a zigzag sell-off.

So the jury is still out regarding a trend reversal until further development. But a near term rebound is likely in progress or in sight.

The best candidate for a corrective decline would be a 4th wave correction with uncertain degree (Chart 2 INDU -blue and green, Chart 3 NDX - blue and green). Whether it is wave 4 or wave [iv] of wave 3 depends on how much one rushes his count. And the correction is likely approaching its end.

The second best candidate for a corrective decline would be the decline toward black point number 6 in our Hope Rally model (Chart 1). In this case, the correction is likely far from over.

Finally, Chart 4 updates the advance/decline line associated with SP500. The current sell-off has taken its toll on market internals.