Five-up in INDU and possibly in Transports - not so obvious in SPX) - raises the odds of low being in place or a 2nd wave rebound. See worst case scenario counts in yesterday's update.

[925am] ES squiggles -

Potential pop and dump.

If the impulse wave count (black) plays out, expect a bullish pop (wave 5-up) and dump (wave 2/B retrace) for the cash market.

If the corrective wave count (red) plays out, expect a weak pop to account for ES overnight advance and then dump.

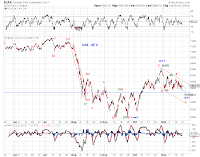

[910am] FTSE, DAX update -

DAX looks more bullish than FTSE, unless both are tracing out an LD-down.

[735am] ES update -

And here is a larger count to pair with the squiggle count (7am entry). See 2nd chart below. If black B, this is a wave [iv] rebound. If green B, the low is in or this is a wave [ii] rebound for wave C extension.

[7am] ES update -

Flat or impulse up from the overnight low.