[Happy New Year] Stocks -

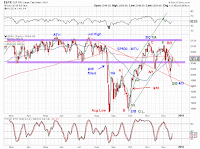

Small degree five-wave decline into the year end. SPX/DOW are negative for the year 2015, bucking their historical tendency. See charts.

[1045am] SPX update -

End of year. Mini-waterfall decline. The proposed retest of the 2010/2020 area is most likely underway, barring a flat pullback (green [b] in Chart 2). See charts.

Disclaimer: Each post is for informational purposes only. It is not a solicitation, a recommendation or advice to buy or sell any security or investment product. Information provided in each post does not constitute investment advice.

Thursday, December 31, 2015

Wednesday, December 30, 2015

Market Timing Update (12/30/15)

[EOD] Stocks-

Inside day. If area around today's low holds, there is potential for "extension" (Chart 1 - 3). Otherwise, the proposed retest of 2010/2020 likely has started (Chart 4). Volatile weeks are likely ahead.

[125pm] SPX update-

Squiggles and tracking counts. See charts.

Inside day. If area around today's low holds, there is potential for "extension" (Chart 1 - 3). Otherwise, the proposed retest of 2010/2020 likely has started (Chart 4). Volatile weeks are likely ahead.

[125pm] SPX update-

Squiggles and tracking counts. See charts.

Tuesday, December 29, 2015

Market Timing Update (12/29/15)

[EOD] Stocks -

The Santa Rally continues (see the last two weekend commentaries). The rally has been impressive in terms of its magnitude, but less so in terms of participation (Chart 1). In addition, price patterns suggest a potential pullback and gap fill (Chart 2). A retest of 2010/2020 looks likely (Chart 3).

[10am] SPX update -

Squiggles, see chart.

The Santa Rally continues (see the last two weekend commentaries). The rally has been impressive in terms of its magnitude, but less so in terms of participation (Chart 1). In addition, price patterns suggest a potential pullback and gap fill (Chart 2). A retest of 2010/2020 looks likely (Chart 3).

[10am] SPX update -

Squiggles, see chart.

Monday, December 28, 2015

Thursday, December 24, 2015

MTU Weekend Ed. - Santa Rally and Looming Volatility (12/24/15)

SPX delivered a golden cross as well as a Santa Rally of 3.085% from its recent low this past week (see Golden Cross, Gap Fill, Santa Rally(12/18/15)). Besides the possibility of the rally continuing (Chart 1-blue, Chart 2-blue,green), price actions open the possibility of meaningful volatility in coming days and weeks (Chart 1-red, Chart 2-gray, red).

These tracking scenarios in SP500 may be corroborated by those in the Dow Transports (discussed last week). See Chart 3 and Chart 4.

Wednesday, December 23, 2015

Market Timing Update (12/23/15)

[EOD] Stocks-

SP500 continues to subdivide higher (Chart 1) and is at the golden cross and trendline congestion area (Chart 2). Mid-to-Small caps are making near term higher highs (Chart 3). Technical indicators are now near term overbought, it'd be prudent to leave some room for a near term pullback.

[1050am] SPX update-

Chart shows squiggles from the nominal low.

SP500 continues to subdivide higher (Chart 1) and is at the golden cross and trendline congestion area (Chart 2). Mid-to-Small caps are making near term higher highs (Chart 3). Technical indicators are now near term overbought, it'd be prudent to leave some room for a near term pullback.

[1050am] SPX update-

Chart shows squiggles from the nominal low.

Tuesday, December 22, 2015

Market Timing Update (12/22/15)

[230pm] SPX update -

SP500 is approaching MA50 on this rebound. See charts for tracking counts and squiggles.

SP500 is approaching MA50 on this rebound. See charts for tracking counts and squiggles.

Monday, December 21, 2015

Market Timing Update (12/21/15)

[EOD] Stocks-

SP500 is in potential small-degree triangle territory as marked on the chart. Bearish or bullish? Let's find out tomorrow.

[145pm] SPX update-

SP500 is in potential small-degree triangle territory as marked on the chart. Bearish or bullish? Let's find out tomorrow.

[145pm] SPX update-

Friday, December 18, 2015

MTU Weekend Ed. - Golden Cross, Gap Fill, Santa Rally (12/18/15)

* SP500 to deliver a golden cross, consistent with a wave [4] triangle interpretation.

* Transports approaches a major retracement support, counts well as a wave [4] pullback, and suggests at least a meaningful rebound.

* Near term, the minimum downside requirement for SP500 is already met. The gap around 1950 represents a target on continued selloff.

SP500 - Golden Cross

In contrast to recent volatility and Friday's swift sell-off, SP500 will deliver a golden cross between its MA50 and MA200 on Monday. While MA50 has been rising, MA200 has been making lower highs since its August peak. Furthermore, Friday's plunge resulted a solid close below both moving averages.

On balance, the moderate underlying technical strength hinted by the golden cross is likely consistent with our interpretation of a wave (E)-down of wave [4]-down after the first rate hike (Chart 1 blue). The top alternative scenarios are also shown in Chart 1. Please also see Wave E-down (12/11/15) for additional details.

Transports - Wave [4] and/or a meaningful rebound

Price actions in the Dow Transports also appear to support the interpretation that wave [4]-down with respect to the 2009 bottom is concluding. From its 2014 peak, the Dow Transports has now retraced a Fib-0.382 of its wave [3]-up, as well as approached potential support implied by its wave [1]-[3] channel (Chart 2). Chart 3 presents tracking counts on the pullback, which suggest at least a meaningful rebound.

SP500 - Minimum Requirement Met and/or Gap Fill

Chart 4-blue presents our tracking of wave (C)-down, (D)-up and (E)-down of this potential wave [4]-down triangle.

The minimum requirement for wave (E)-down has been met after Friday's plunge. It would be the case if wave B-up is a running flat (i.e. the middle blue B in Chart 4). Note that Friday's low/close is now lower than the wave A low.

If wave (E)-down continues to subdivide, the unfilled gap around 1950 would be an reasonable target.

Thursday, December 17, 2015

Market Timing Update (12/17/15)

[EOD] Stocks -

SPX continued to fall off the wedge as hinted by price actions yesterday, has the potential to fill the gap below. See charts for tracking counts and squiggles.

[1150am] SPX update -

SPX fell off the wedge as hinted by price actions yesterday. See charts for tracking counts and squiggles.

SPX continued to fall off the wedge as hinted by price actions yesterday, has the potential to fill the gap below. See charts for tracking counts and squiggles.

[1150am] SPX update -

SPX fell off the wedge as hinted by price actions yesterday. See charts for tracking counts and squiggles.

Wednesday, December 16, 2015

Market Timing Update (12/16/15)

[EOD] Stocks-

SP500 closed above its MA50 as well as MA200 (Chart 1). Near term, SP500 is wedging at a couple of degrees (Chart 2). The current advance is tracked as the blue wave [i] of a new upswing or the red wave [c] of an expanded running flat rebound.

[950am] SPX update-

Fed Day. SPX is within 2 points of a golden cross. At the same time, both MAs represent potential overhead resistance. See charts for tracking counts and squiggles.

SP500 closed above its MA50 as well as MA200 (Chart 1). Near term, SP500 is wedging at a couple of degrees (Chart 2). The current advance is tracked as the blue wave [i] of a new upswing or the red wave [c] of an expanded running flat rebound.

[950am] SPX update-

Fed Day. SPX is within 2 points of a golden cross. At the same time, both MAs represent potential overhead resistance. See charts for tracking counts and squiggles.

Tuesday, December 15, 2015

Market Timing Update (12/15/15)

[EOD] Stocks -

[940am] SPX update-

SPX is once again facing resistance from its 2015 topping zone (Chart 1). It SPX chooses to retest the red trend line off the July high in Chart 1, Chart 2 presents a potential small-degree expending EDT count.

[940am] SPX update-

SPX is once again facing resistance from its 2015 topping zone (Chart 1). It SPX chooses to retest the red trend line off the July high in Chart 1, Chart 2 presents a potential small-degree expending EDT count.

Monday, December 14, 2015

Market Timing Update (12/14/15)

[EOD] Stocks -

Transports looks interesting (Chart 1, Chart 2) SPX update (Chart 3, Chart 4) .

[1040am] SPX update -

Corrective decline. See charts.

Transports looks interesting (Chart 1, Chart 2) SPX update (Chart 3, Chart 4) .

[1040am] SPX update -

Corrective decline. See charts.

Subscribe to:

Comments (Atom)