Stocks, Bonds, USD, Gold - key intermediate term scenarios to watch

Stocks

In contrast to the rebound from the Sep/Oct low in stocks, the rebound from the November low has been led by small-to-mid-cap stocks, which is (near term) bullish (Chart S1).

However, if the rebound from the November low is the green wave 5 in Chart S2, this wave 5 has the potential to fail or to extend (See Extension or Truncation (11/20/15)).

Even in the case of an extension, the squiggle counts in Chart S3 suggest that the green wave [ii]-down of wave 5-up or the red wave [x]-down have room for one more pullback. This would be consistent with the implication of a small-degree impulse-wave decline in SP500 emini futures (Chart S4).

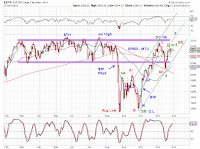

Chart S5 updates the scenarios where the proposed wave [4] off the 2009 low or the 2010 low is over (green) or not (blue and red).

Bonds

10-year U.S. Treasury yield has retreated from the right shoulder of a potential head-and-shoulders pattern (Chart B1) and is now retesting the gray break out line. Logical initial targets are around 2.5% or 1.95%, depending on whether the retest succeeds or fail. There has been little change in the long-term profile of yields (Chart B2)

USD

The USD index is forming a potential ending diagonal triangle (Chart $1). Unless a green wave [v] is already underway (which appears less likely), the potential EDT suggests at least a pullback. The initial target would be slightly below the 99 level.

Gold

Gold prices fell to a new bear-market low over the past month, as suspected. Based on Gold's price actions, the likelihood of a 3-year EDT has meaningfully increased (Chart G1, green). Under this interpretation, we expect gold to rebound in a small degree (b)-wave, followed by a small-degree (c)-wave decline to a lower low above $956.20 to finish off this potential EDT.

Disclaimer: Each post is for informational purposes only. It is not a solicitation, a recommendation or advice to buy or sell any security or investment product. Information provided in each post does not constitute investment advice.

Saturday, November 28, 2015

Friday, November 27, 2015

Wednesday, November 25, 2015

Market Timing Update (11/15/15)

[730am] ES update -

Full moon. Potential IHS forming, targeting 2125, failure of which points to 2035. See chart.

Full moon. Potential IHS forming, targeting 2125, failure of which points to 2035. See chart.

Tuesday, November 24, 2015

Monday, November 23, 2015

Saturday, November 21, 2015

MTU Weekend Ed. - Extension or Truncation (11/20/15 close)

... draft in progress, subject to change ...

SP500 has rebounded smartly from its mid-November pullback low (Chart 1). We track the rebound as a B wave on the bearish side (Chart 1, red) or a 5th wave on the bullish side (Chart 1, green).

If the bullish wave 5 does not extend (as in Chart 2 green), it is possible to count the rebound as complete, resulting in a 5th wave failure (see Chart 2 blue and Chart 3).

SP500 has rebounded smartly from its mid-November pullback low (Chart 1). We track the rebound as a B wave on the bearish side (Chart 1, red) or a 5th wave on the bullish side (Chart 1, green).

If the bullish wave 5 does not extend (as in Chart 2 green), it is possible to count the rebound as complete, resulting in a 5th wave failure (see Chart 2 blue and Chart 3).

Thursday, November 19, 2015

Market Timing Update (11/19/15)

[EOD] Stocks-

A potential bullish triangle for the near term. Let's see if it succeeds or fails. See charts.

A potential bullish triangle for the near term. Let's see if it succeeds or fails. See charts.

Wednesday, November 18, 2015

Market Timing Update (11/18/15)

[EOD] Stocks -

[815am] ES update -

Yesterday's attempt to break above the HS neckline (red) was not successful. ES is currently bumping against the neckline again. See chart.

[815am] ES update -

Yesterday's attempt to break above the HS neckline (red) was not successful. ES is currently bumping against the neckline again. See chart.

Tuesday, November 17, 2015

Market Timing Update (11/17/15)

[EOD] Stocks -

SP500 rebounded from the red trend line support and also closed inside its prior topping zone yesterday (Chart 1). Today, SP500 is unable to break the gray resistance line in Chart 2. The pullback from today's high is retesting the lower edge of the topping zone in Chart 1. An unfilled gap sits above today's high and we will know in the next few days if the poke inside the topping zone will fail.

[12pm] SPX update -

SP500 rebounded from the red trend line support and also closed inside its prior topping zone yesterday (Chart 1). Today, SP500 is unable to break the gray resistance line in Chart 2. The pullback from today's high is retesting the lower edge of the topping zone in Chart 1. An unfilled gap sits above today's high and we will know in the next few days if the poke inside the topping zone will fail.

[12pm] SPX update -

Friday, November 13, 2015

MTU Weekend Ed. - Head and Shoulders (11/13/15 close)

Very-large-caps got rejected by the top of their 2015 topping zone and are retesting the bottom of that topping zone, while mid-and-small-caps got rejected by their 2015 topping zone altogether (Chart 1).

The combined effect is a rejection by the 2015 topping zone in SP500 (Chart 2). SP500 is now testing a prior bearish trend line (Chart 2 red trend line), which could provide potential support for the near term. In addition, a successful head-and-shoulders pattern in ES which we have been tracking over the past week has now reached its projected target (Chart 3)

At a larger degree, SP500 appears to be following the red and blue scenarios we been tracking in Chart 4.

The combined effect is a rejection by the 2015 topping zone in SP500 (Chart 2). SP500 is now testing a prior bearish trend line (Chart 2 red trend line), which could provide potential support for the near term. In addition, a successful head-and-shoulders pattern in ES which we have been tracking over the past week has now reached its projected target (Chart 3)

At a larger degree, SP500 appears to be following the red and blue scenarios we been tracking in Chart 4.

Market Timing Update (11/13/15)

[745am] ES update-

The HS in ES is in progress. Let's see if it reaches its projected target. See chart.

The HS in ES is in progress. Let's see if it reaches its projected target. See chart.

Thursday, November 12, 2015

Market Timing Update (11/12/15)

[EOD] Stocks -

SP500 fills a prior gap and makes a round trip in its prior topping zone (Chart 1 and Chart 2). Midcaps and Smallcaps were rejected by their prior topping zone (Chart 3).

[840am] ES update -

ES is testing a potential HS (identified yesterday) neckline. See chart.

SP500 fills a prior gap and makes a round trip in its prior topping zone (Chart 1 and Chart 2). Midcaps and Smallcaps were rejected by their prior topping zone (Chart 3).

[840am] ES update -

ES is testing a potential HS (identified yesterday) neckline. See chart.

Wednesday, November 11, 2015

Monday, November 9, 2015

Market Timing Update (11/9/15)

[EOD] Stocks -

The decline in SP500 is being tracked as a completed nested LDT (red), a completed flat (blue) or an incomplete impulse (gray), see Chart 1. At a larger degree, SP500 has been rejected by the top of its prior topping zone, testing its MA200. If MA200 fails, targets are the gap around 2050, the bottom of its prior topping zone, MA50 then the gap around 1950. See Chart 2.

The decline in SP500 is being tracked as a completed nested LDT (red), a completed flat (blue) or an incomplete impulse (gray), see Chart 1. At a larger degree, SP500 has been rejected by the top of its prior topping zone, testing its MA200. If MA200 fails, targets are the gap around 2050, the bottom of its prior topping zone, MA50 then the gap around 1950. See Chart 2.

Saturday, November 7, 2015

MTU Weekend Ed. - Fourth Wave (11/6/15 close)

The new high in NDX (Chart 1) increases the likelihood that the sell-off in Q3 is part of a fourth wave (Chart 2). While the new high in NDX and the strong upside momentum in SP500 hints at new highs in SP500, the notable disparity along the market-cap dimension has persisted (Chart 3). It is likely that the proposed fourth wave is still incomplete.

Near term, if the market is ready to pull back, one can count the decline last week as a leading diagonal triangle. Otherwise, the overlapping nature of the decline suggests a small-degree fourth wave. See Chart 4 and Chart 5.

Friday, November 6, 2015

Market Timing Update (11/6/15)

[1015am] SPX update -

As a follow-up on yesterday's EOD update, we now potentially have a proper LDT or double/triple-three combo in SP500. See charts.

As a follow-up on yesterday's EOD update, we now potentially have a proper LDT or double/triple-three combo in SP500. See charts.

Thursday, November 5, 2015

Market Timing Update (11/5/15)

[EOD] Stocks -

SP500 closed below prior support (Chart 1, red trend line) despite the overlapping (corrective-looking) decline (Chart 2). One near term scenario to monitor would be a retest of the red trend line in Chart 1. If a potential retest ends up being rejected by prior support trend line, the leading diagonal triangle (Chart 2,red) is likely playing out.

SP500 closed below prior support (Chart 1, red trend line) despite the overlapping (corrective-looking) decline (Chart 2). One near term scenario to monitor would be a retest of the red trend line in Chart 1. If a potential retest ends up being rejected by prior support trend line, the leading diagonal triangle (Chart 2,red) is likely playing out.

Wednesday, November 4, 2015

Market Timing Update (11/4/15)

[EOD] Stocks -

Likely a corrective decline (7 waves down) "unless" a small-degree bearish triangle is in progress. See charts.

[820am] ES update -

Potential triangle (w4 or terminal w5), see chart

Likely a corrective decline (7 waves down) "unless" a small-degree bearish triangle is in progress. See charts.

[820am] ES update -

Potential triangle (w4 or terminal w5), see chart

Subscribe to:

Comments (Atom)