Disclaimer: Each post is for informational purposes only. It is not a solicitation, a recommendation or advice to buy or sell any security or investment product. Information provided in each post does not constitute investment advice.

Saturday, November 30, 2013

Monthly Outlook Update (11/29/13 close)

Stocks

The advance since the October low in SP500 may have topped at the recent record high (Chart 1, blue) or is missing an overthrow of a potential ending diagonal triangle (Chart 1, green).

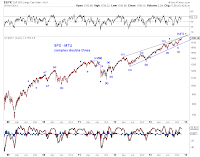

As discussed in Potential Pullback (11/22/13) , from a bearish perspective, the near term price actions also complete a double three (double zigzag) structure off the June low (Chart 2), which in turn offers to complete a larger double three structure since the 2009 bottom in stocks (Chart 3, blue).

This bearish interpretation of the 5-year advance suggests a deep pull back or a full retrace.

A bullish interpretation of the 5-year advance has the pending high as a wave three (of uncertain degree). See Chart 4-green. This interpretation suggests shallow(er) pullbacks, perhaps toward the 1650 area.

Bonds

Long dated U.S. interest rates, as proxied by the 10Y Treasury yield index, are tracking a fifth wave north (Chart 5, green) or a subdivision south to complete an EDT (Chart 5, red). Chart 6 shows how these near term structures fit into the long term picture. Odds continue to favor higher yields at the moment.

US Dollar

Recent strength in the USD index raises the prospects of a multi-year upward flat (Chart 7, black [c]) as the squiggle count on the daily chart (Chart 8, blue) hints. At this stage, the burden of proof is on the bulls, as a five-year overhead resistance represents a major challenge. If USD fails to break above, various long term triangles highlighted in Chart 7 are at play and the dollar could be stuck in this wide range for the next year to two.

Gold

Gold has drifted lower to retest its June low, making a potential truncated 5th wave premature.

At the moment, the June low is holding, barely. Thus, on the bearish side, we track a head-and-shoulders target area around 1150 or a much higher low if the subdivision lower turns out to be an ending diagonal triangle. See Chart 9-red.

At the same time, the decline in gold prices exhibit personalities of a corrective retrace (Chart 9-blue). Thus, on the bullish side, we track at least an upward flat.

Chart 10 updates the larger tracking counts.

Wednesday, November 27, 2013

Tuesday, November 26, 2013

Market Timing Update (11/26/13)

[EOD] Stocks -

The minimum requirement of a high discussed in Potential Pullback (11/22/13) is now met at today's high (Chart 1, blue). But leave room for an EDT if the market subdivides higher (Chart 1, green) - the EDT in SPX mirrors the one discussed in this morning's ES update.

[815am] ES update -

Note the red (5) or red C wedge tracking count if an "extra" wave shows up on the squiggles. See chart.

The minimum requirement of a high discussed in Potential Pullback (11/22/13) is now met at today's high (Chart 1, blue). But leave room for an EDT if the market subdivides higher (Chart 1, green) - the EDT in SPX mirrors the one discussed in this morning's ES update.

[815am] ES update -

Note the red (5) or red C wedge tracking count if an "extra" wave shows up on the squiggles. See chart.

Monday, November 25, 2013

Market Timing Update (11/25/13)

[EOD] Stocks-

[810am] ES update-

ES is up against multiple upper channel lines. See tracking counts (Chart 1), and Potential Pullback (11/22/13) for discussion.

[810am] ES update-

ES is up against multiple upper channel lines. See tracking counts (Chart 1), and Potential Pullback (11/22/13) for discussion.

Saturday, November 23, 2013

MTU Weekend Ed. - Potential Pullback (11/22/13 close)

We expect to see a pull back in SP500 toward 1650 area before long. The new record high of 1804.84 this past week once again hugs the longer term resistance line “responsible” for the 2010, 2011 and 2013 corrections (Chart 1).

A small-degree five wave advance from the November low is ending (Chart 2), around the projected area of an inverse head-and-shoulders pattern at a larger degree (Chart 3). Also note the two unfilled gaps around 1785 and 1745 during the recent rally.

From a bearish perspective, the near term price actions also complete a double three (double zigzag) structure off the June low (Chart 4), which in turn offers to complete a larger double three structure since the 2009 bottom in stocks (Chart 5).

While long term bullish counts (such as those discussed in our weekly commentaries) remain on the table, many of them also point to a short term pullback.

A small-degree five wave advance from the November low is ending (Chart 2), around the projected area of an inverse head-and-shoulders pattern at a larger degree (Chart 3). Also note the two unfilled gaps around 1785 and 1745 during the recent rally.

From a bearish perspective, the near term price actions also complete a double three (double zigzag) structure off the June low (Chart 4), which in turn offers to complete a larger double three structure since the 2009 bottom in stocks (Chart 5).

While long term bullish counts (such as those discussed in our weekly commentaries) remain on the table, many of them also point to a short term pullback.

Thursday, November 21, 2013

Market Timing Update (11/21/13)

[EOD] Stocks -

[945am] SPX update -

SPX has retested the prior breakout area. Let's see if it holds. See charts.

[945am] SPX update -

SPX has retested the prior breakout area. Let's see if it holds. See charts.

Wednesday, November 20, 2013

Tuesday, November 19, 2013

Market Timing Update (11/19/13)

[EOD]Stocks-

The plot thickens. See charts.

[1020am]SPX update -

A completed downward flat in SP500 and relatively more bullish action in other indexes make a decent potential small-degree 4th wave. See charts.

The plot thickens. See charts.

[1020am]SPX update -

A completed downward flat in SP500 and relatively more bullish action in other indexes make a decent potential small-degree 4th wave. See charts.

Monday, November 18, 2013

Market Timing Upddate (11/18/13)

[EOD] Stocks -

A potential downward flat if the decline stops near here, making a decent small-degree 4th wave as indicated. Meaningful downside potential otherwise.

[205pm] SPX Update -

[820am] ES Update -

See New High (3) (11/15/13) for discussion.

A potential downward flat if the decline stops near here, making a decent small-degree 4th wave as indicated. Meaningful downside potential otherwise.

[205pm] SPX Update -

[820am] ES Update -

See New High (3) (11/15/13) for discussion.

Saturday, November 16, 2013

MTU Weekend Ed - New High (3) (11/15/13 Close)

SP500 finally took out its October top and made a new record high this past week amid Yellen-driven bullish sentiment. The breakout was also on the back of a potential inverse head-and-shoulders pattern (Chart 1) which points to a measured target around 1805. Friday’s high in SP500 was 1798.22.

We track the pending small degree high as

[red] the end (wave 5) of the advance since the October low. Note that the Dow made a lower low in October. This particular top can also serve as the end of a complex double three structure since the 2009 low (Chart 3, blue), or the end of wave (C) of a diagonal triangle since the 2009 low (Chart 5).

[green] wave [iii] of wave 5 of the advance since the October low, suggesting one more down-up subdivision for this particular wave.

[blue] wave 3 of a fresh upswing since the November low. Note that the upswing since the November low can also extend following the initial five-wave advance.

At this juncture, the big-picture tracking counts are both more relevant and interesting. See Monthly Outlook Update (11/1/13).

As anticipated, SP500 continues to crawl along the green upper resistance line (Chart 2) as it makes higher highs. See Short Term Update (11/8/13).

Chart 3 updates the progress of a complex double three structure since the 2009 low.

Chart 4 updates its bullish counterpart.

Chart 5 updates the progress of a potential diagonal triangle since the 2009 low.

We track the pending small degree high as

[red] the end (wave 5) of the advance since the October low. Note that the Dow made a lower low in October. This particular top can also serve as the end of a complex double three structure since the 2009 low (Chart 3, blue), or the end of wave (C) of a diagonal triangle since the 2009 low (Chart 5).

[green] wave [iii] of wave 5 of the advance since the October low, suggesting one more down-up subdivision for this particular wave.

[blue] wave 3 of a fresh upswing since the November low. Note that the upswing since the November low can also extend following the initial five-wave advance.

At this juncture, the big-picture tracking counts are both more relevant and interesting. See Monthly Outlook Update (11/1/13).

As anticipated, SP500 continues to crawl along the green upper resistance line (Chart 2) as it makes higher highs. See Short Term Update (11/8/13).

Chart 3 updates the progress of a complex double three structure since the 2009 low.

Chart 4 updates its bullish counterpart.

Chart 5 updates the progress of a potential diagonal triangle since the 2009 low.

Subscribe to:

Comments (Atom)