Chart 2 tracks the potential final upswing since the February low. The current high counts as

(blue) the end of an impulse wave with an extended fifth wave.

(red) the end of an ABC structure with an expanding EDT.

(green) an initial high of wave [c] or [iii] up.

Odds appear to favor the green count at the moment, given the time constraint and a breaching low in NDX this past week.

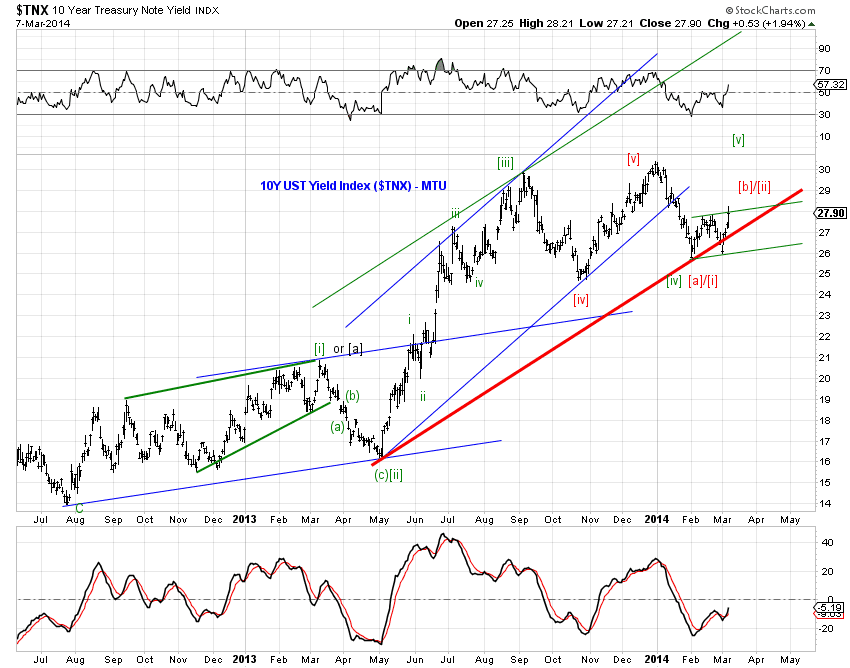

In bonds, the trend line through the 2013 and 2014 lows in 10Y yields held (Chart 3), pushing the 10Y yield back toward 2.8%. The tug-of-war between the green and red counts continues. However, since either count now suggests a third wave in progress or about to surface, expect fast bond movements in the following weeks.