[1025am] SPX update -

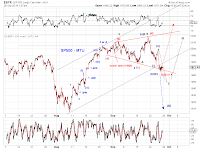

Month end. Tracking counts. See charts. Note a potential small-degree 4th wave bearish triangle or small-degree wave c bullish terminal triangle, discussed yesterday.

Disclaimer: Each post is for informational purposes only. It is not a solicitation, a recommendation or advice to buy or sell any security or investment product. Information provided in each post does not constitute investment advice.

Tuesday, September 30, 2014

Monday, September 29, 2014

Market Timing Update (9/29/14)

[EOD] Stocks-

Squiggles present a number of near term possibilities. See chart. Note that the top "immediately bearish count" is likely a fourth wave triangle (or an LTD decline from the nominal high) in SPX, as outlined in the chart.

[12pm] SPX update-

[705am] ES update-

Squiggles present a number of near term possibilities. See chart. Note that the top "immediately bearish count" is likely a fourth wave triangle (or an LTD decline from the nominal high) in SPX, as outlined in the chart.

[12pm] SPX update-

[705am] ES update-

Sunday, September 28, 2014

MTU Weekend Ed. - Terminal Move 4 (9/26/14)

This past Friday’s low in SP500 likely marked the end of a month-long expanding triangle, one of the top scenarios which we have been tracking. The expanding triangle would count as a wave 4 or wave B off the August low. See Chart 1 red.

While a wave B can accommodate a meaningful wave C advance, a wave 4 suggests a limited upswing. The proposed 5th wave could very well fail as the minimum threshold for a full wave 5 is 2005.04 (Chart 1).

On the bearish side, the run since the 2011 low may have already ended at the September high. It’s possible that stocks have been tracing out a very bearish series of wave 1s and 2s (Chart 1, blue). However, the deep rebound this past Friday after a three-wave decline deserves attention. Secondly, one of our tracking counts on the advance since the 2011 low points to a timed topping window which is approaching, but not yet passed (Chart 2). Thus, it’s a good idea to view the next two weeks as a window where the market can sort things out.

While a wave B can accommodate a meaningful wave C advance, a wave 4 suggests a limited upswing. The proposed 5th wave could very well fail as the minimum threshold for a full wave 5 is 2005.04 (Chart 1).

On the bearish side, the run since the 2011 low may have already ended at the September high. It’s possible that stocks have been tracing out a very bearish series of wave 1s and 2s (Chart 1, blue). However, the deep rebound this past Friday after a three-wave decline deserves attention. Secondly, one of our tracking counts on the advance since the 2011 low points to a timed topping window which is approaching, but not yet passed (Chart 2). Thus, it’s a good idea to view the next two weeks as a window where the market can sort things out.

Friday, September 26, 2014

Market Timing Update (9/26/14)

[105pm] SPX update -

tracking counts and squiggles. see charts.

[9am] ES update -

potentially a small-degree 5th wave down to wrap up a zigzag/121/123. See charts.

tracking counts and squiggles. see charts.

[9am] ES update -

potentially a small-degree 5th wave down to wrap up a zigzag/121/123. See charts.

Thursday, September 25, 2014

Market Timing Update (9/25/14)

[EOD] Stocks -

[1040am] SPX update -

Charts shows tracking counts. Monitoring potential small-degree and a larger-degree expanding triangles in SPX as highlighted in these charts, as well as potential terminal triangle (bearish) in RUT (not shown).

[1040am] SPX update -

Charts shows tracking counts. Monitoring potential small-degree and a larger-degree expanding triangles in SPX as highlighted in these charts, as well as potential terminal triangle (bearish) in RUT (not shown).

Wednesday, September 24, 2014

Tuesday, September 23, 2014

Monday, September 22, 2014

Market Timing Update (9/22/14)

[EOD] Stocks -

[815am] ES/YM/NQ update-

State of retreat across futures - see charts. See weekend commentary for near term tracking scenarios.

[815am] ES/YM/NQ update-

State of retreat across futures - see charts. See weekend commentary for near term tracking scenarios.

Friday, September 19, 2014

MTU Weekend Ed. - Terminal Move 3 (9/19/14)

...draft in progress, subject to change ...

SP500 recovered from its mid-September low smartly and delivered another record high this past week. Based on the squiggles of this move, Friday's high is either the end of an EDT (Chart 1, red) or wave three of an impulse wave (Chart 1, blue). Odds appear to favor the latter (with the exception of a potential B-wave, see discussions below). These possibilities are more conspicuous in the wave structure of NDX.

Depending on whether this past week's move is part of the upswing since the August low, we track several interesting near term scenarios. See Chart 2.

[red] Wave 5 off the August low topped at Friday's high. The August low is likely at risk on the next downswing.

[blue] Wave 5 off the August low is incomplete. Wave [v] of 5 is next, targeting the 2030 area.

[black] Wave 4 off the August low is tracing out a lengthy expanding triangle. Wave [e] pullback is next, which is likely to breach 1980. Wave 5-up that follows could fail as any move above 2005 would satisfy the minimum requirement.

[green] The upswing off the August low is extending. Friday's high is wave B-up of an expanded flat or a triangle consolidation before a fresh upswing surfaces. Wave C-down of this consolidation is next.

SP500 recovered from its mid-September low smartly and delivered another record high this past week. Based on the squiggles of this move, Friday's high is either the end of an EDT (Chart 1, red) or wave three of an impulse wave (Chart 1, blue). Odds appear to favor the latter (with the exception of a potential B-wave, see discussions below). These possibilities are more conspicuous in the wave structure of NDX.

Depending on whether this past week's move is part of the upswing since the August low, we track several interesting near term scenarios. See Chart 2.

[red] Wave 5 off the August low topped at Friday's high. The August low is likely at risk on the next downswing.

[blue] Wave 5 off the August low is incomplete. Wave [v] of 5 is next, targeting the 2030 area.

[black] Wave 4 off the August low is tracing out a lengthy expanding triangle. Wave [e] pullback is next, which is likely to breach 1980. Wave 5-up that follows could fail as any move above 2005 would satisfy the minimum requirement.

[green] The upswing off the August low is extending. Friday's high is wave B-up of an expanded flat or a triangle consolidation before a fresh upswing surfaces. Wave C-down of this consolidation is next.

Thursday, September 18, 2014

Market Timing Update (9/18/14)

[EOD] Stocks-

If this potential EDT tracks (see 1215pm update), SP500 cash index is likely capped at 2026.03 for the upswing since the early September low. See chart.

[1215pm] SPX update-

Potential small-degree EDTs. See charts.

[845am] ES update-

If this potential EDT tracks (see 1215pm update), SP500 cash index is likely capped at 2026.03 for the upswing since the early September low. See chart.

[1215pm] SPX update-

Potential small-degree EDTs. See charts.

[845am] ES update-

Wednesday, September 17, 2014

Market Timing Update (9/17/14)

[EOD] Stocks-

The minimum requirement for completion of wave 5 (Chart 1, red) has been met. Wave [v] of 5 may or may not extend (Chart 1, blue). Let's see what tomorrow's session brings.

[730am] ES update-

The minimum requirement for completion of wave 5 (Chart 1, red) has been met. Wave [v] of 5 may or may not extend (Chart 1, blue). Let's see what tomorrow's session brings.

[730am] ES update-

Tuesday, September 16, 2014

Subscribe to:

Comments (Atom)