Last Week (1/24/20) Tracking count from Reversal or Small-Degree Pullback (1/24/20)

This Week (1/31/20), the size of the net decline from ATH, based on wave degree considerations, eliminates the small-degree pullback (green scenario in Chart 2 above, b-down of (z)[e]-up form the red X in Chart 1 above).

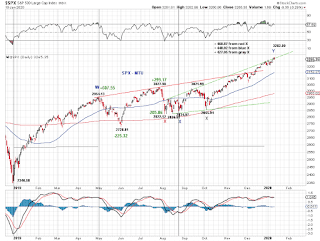

Chart 3 below updates Chart 2 incorporating this week's additional sell-off.

Furthermore, the possibility of a larger-degree pullback remains (green scenario in Chart 3 below, [b]-down of Y-up from the grey X in Chart 1).

Chart 4 and Chart 5 update the triple-zigzag or the impulse tracking from the Oct low in ES.